NAIAD that follows the ambitious objective to operationalize the insurance value of ecosystems to reduce the risks associated with water (floods and drought) has explored the insurance schemes on 11 EU member countries (Germany, Italy, Slovenia, Denmark, Sweden, Poland, The Netherlands, United Kingdom, France, Spain and Romania).

The goal of this research, led by Icatalist (Spain), IRSTEA (France) and DELTARES (The Netherlands), is to offer new insights into the role of insurance industry in addressing the goals of disaster risk reduction and climate change adaptation. It highlights the role of the insurance sector in the efforts to make society more resilient and support the transition to ex-ante disaster risk management paradigm.

Understanding the European natural hazards insurance business models is crucial to leverage the industry’s contributions to achieve climate change adaptation and disaster risk reduction goals and targets. European Insurance schemes are significantly different from one country to another another, according to the type of contracts, prices, coverage, cultural risk and insurance perception.

The 11 Insurance Schemes studied can be classified as:

-

Voluntary insurance (Germany, Italy, Slovenia),

-

Semi-voluntary (Denmark, Sweden, Poland, the Netherlands and United Kingdom) and

-

Mandatory (France, Spain and Romania).

*The detailed schemes can be checked at NAIAD website: wwwnaiad2020.eu: Resources

The research include three recommendations for stakeholders to take into account when tailoring new business models.

Recommendation 1

The European Commission has to consider insurance schemes’ differences to reinforce and create harmonized linkages between climate change adaptation/disaster risk reduction (CCA/DRR) policies and insurance businesses. New policies mainstreaming ecosystem based disaster risk reduction measures (Eco-DRR) and insurers’ contribution, could be based on public-private partnerships (PPPs). Thus, it is an opportunity to promote risk awareness, risk reduction and to bridge the knowledge gap in the insurance industry on prevention measures.

Recommendation 2

The interviews revealed the need for Nature-based Flood-Directive based on the same principle as the Floods Directive (risk maps integrating protective measures, greener risk financing). Interviews also revealed the need for clear European and national roadmaps for sustainable insurance. However, there are divergent opinions on the idea of an EU imposition. This is linked to the EU proposal to foster insurance industry in DRR.

Recommendation 3

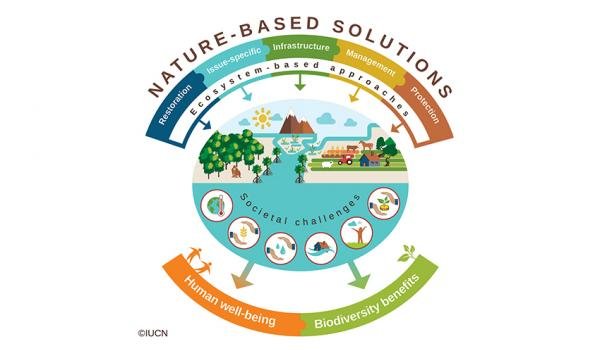

Projects like NAIAD scale-up experimenting, testing and demonstrating the applicability of NBS, challenge the EU on the policy interaction between NBS implementation and current protected areas (Natura 2000, ZNIEFF etc.) The EU could base future policies on NAIAD standards for NBS implementation. The key challenges are to determine the insurance value of ecosystems and to assess the multiple benefits of DRR whether disaster strikes or not. We are facing undergoing rapid changes based on increasing integrated approaches.